In today’s fast-paced digital world, individuals are constantly seeking new ways to enhance their financial well-being. With the rise of technology and its integration into our everyday lives, innovative solutions for managing personal finances have become more accessible than ever. Exploring these opportunities can lead to significant advantages in achieving financial freedom and security.

Among various platforms offering unique benefits, some stand out by providing exceptional incentives for users. These platforms enable individuals to not only manage their funds effectively but also to explore exciting avenues for multiplying their resources. Understanding how to navigate these systems can open doors to remarkable financial prospects.

As we delve into the strategies that allow savvy users to maximize their earnings, it’s essential to remain informed and proactive. By grasping the nuances of these platforms and their offerings, individuals can make informed decisions that enhance their financial landscape. Take the first step toward transforming your economic future and unlock the potential that these digital tools offer.

Gaining access to exclusive financial opportunities can be a game changer. Individuals looking to enhance their financial situation may find methods to tap into hidden resources that offer significant rewards. Knowing the steps to harness these options can make a considerable difference.

First and foremost, it’s important to familiarize yourself with available channels and platforms. Many resources provide essential insights, guiding users through processes that optimize their potential benefits. Explore forums, social media groups, and websites dedicated to financial growth, where shared experiences can lead to valuable discoveries.

Engagement with these communities can often yield practical advice and firsthand accounts of successful navigation through various financial avenues. Whether it’s through direct interactions or by consuming shared content, immersing oneself allows for a better understanding of how others have achieved their goals.

Once you’ve gathered adequate information, implementing your knowledge becomes critical. Identify legitimate offers, ensure safety in transactions, and prepare to actively participate. Staying vigilant and informed will empower you to make the most of available opportunities.

By consistently educating yourself and engaging with knowledgeable peers, you’ll be well-positioned to take advantage of unique financial prospects that may come your way.

This section aims to guide you through a series of straightforward actions to access your desired funds efficiently. Following these steps will ensure that you navigate the process without unnecessary complications.

By adhering to these instructions, you will maximize your chances of successfully obtaining your funds in a quick and efficient manner.

Engaging with the application requires a straightforward procedure that allows new users to join the platform efficiently. Understanding the necessary steps can enhance the overall experience and ensure a smooth initiation.

To begin, individuals need to visit the official website or download the software version compatible with their device. Once the application is installed, users will find a prominent option to create a new account. Selecting this will guide them through a series of prompts designed to gather essential information.

During this phase, it is crucial to provide accurate personal details such as name, email address, and phone number. After entering the required information, users may be asked to establish a secure password to protect their profile. Once these details are confirmed, verifying the email or phone number through a confirmation link or code is often necessary.

Finalizing the registration involves accepting the platform’s terms and conditions, which outline user responsibilities and rights. After successfully completing all steps, new users can start exploring the features available to them in the application.

Understanding the sign-up procedure thoroughly ensures you can access all functionalities without unnecessary delays.

Verification of unique identifiers is an essential process aimed at ensuring the authenticity and security of transactions. This procedure is crucial for protecting users from potential fraud and unauthorized access. By confirming that a specific code is valid and belongs to the intended user, platforms can provide a safer experience and reinforce trust among their clientele.

Typically, the verification process involves receiving a numeric or alphanumeric sequence, which must be entered in a designated area. Once submitted, the system checks the input against its database, validating whether it corresponds to a legitimate account or transaction. A successful match often leads to further access or completion of a specific action.

It is important for users to understand that maintaining the confidentiality of these codes is vital. Sharing them with untrusted sources can result in potential losses and security breaches. Regularly updating passwords and employing unique identifiers can add an extra layer of protection.

In summary, proper verification of unique keys plays a pivotal role in maintaining the integrity of digital financial transactions. Users are encouraged to follow best practices to safeguard their personal information and enhance their overall user experience.

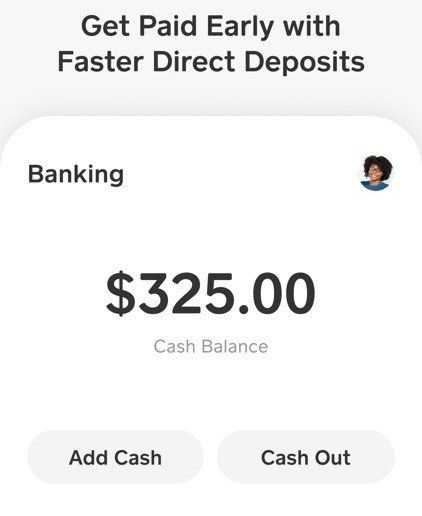

Establishing a financial balance within your platform account is crucial for smooth transactions. There are various methods to obtain sufficient funds, ensuring you have flexibility in managing your finances. Each approach has unique features and benefits that cater to diverse user needs.

Bank Transfers offer a reliable way to move money directly from your checking or savings account. This traditional method typically requires a few business days for processing but provides a secure option for those preferring established banking practices.

Debit and Credit Cards serve as swift alternatives, allowing for instant deposits. Users can seamlessly link their cards to the account, enabling immediate access to funds. However, it’s essential to be aware of any associated fees that might apply with certain card transactions.

Email Transfers represent another convenient method. By utilizing this feature, users can receive funds from other individuals effortlessly. This peer-to-peer approach is not only quick but often carries minimal costs, making it an attractive choice for many users.

Lastly, consider promotional bonuses or incentives that some platforms offer upon initial funding. These offers can enhance your starting balance, granting you additional resources to explore various features or services.

To make the most of your financial opportunity, strategic planning and informed decisions are essential. By understanding the various avenues available to you, it becomes feasible to enhance your experience and outcomes. The following tips will serve as a guide to navigating this financial landscape effectively.

1. Understand Terms and Conditions: Make sure you are fully aware of any requirements, limitations, or fees associated with the withdrawal process. Knowledge of these conditions can prevent unpleasant surprises.

2. Explore Investment Options: Instead of spending the amount immediately, consider putting it into investments that have the potential to grow over time. This can include stocks, bonds, or even a savings account with higher interest rates.

3. Budget Wisely: Create a detailed budget to manage your finances efficiently. Allocating funds to essential areas can lead to better stability and oversight.

4. Take Advantage of Promotions: Look out for any ongoing promotions or offers that could benefit you. Companies often have incentives that can enhance your financial standing.

5. Consult Financial Advisors: If you feel overwhelmed, do not hesitate to seek professional advice. Financial experts can provide valuable insights tailored to your situation, helping you make sound decisions.

By employing these strategies, you can ensure that your financial gains are not only maximized but also leveraged for future growth and stability.

When engaging with digital payment platforms, it is essential to be aware of various restrictions that govern fund accessibility. These limitations can impact users’ ability to transfer money promptly and may differ widely across various services. Familiarizing oneself with these parameters can enhance the overall experience and help in planning financial strategies.

Withdrawal limits often dictate how much money can be retrieved within a specific timeframe, commonly set on a daily, weekly, or monthly basis. Factors influencing these restrictions include the type of account, user history, and verification status. Therefore, users should ensure that they fully understand their personal limits to avoid any inconvenience.

Moreover, certain platforms may also impose additional barriers when it comes to specific transaction types or conditions. For instance, some transfers might face stricter controls, particularly when dealing with large sums. This is often a security measure intended to protect users and prevent fraud.

In conclusion, grasping the nuances of withdrawal constraints is crucial for effective online money management. Being informed allows individuals to navigate their financial operations efficiently while minimizing potential frustrations associated with unexpected limitations.

Connecting your financial institution to your mobile payment platform is a crucial step in ensuring seamless transactions and managing funds efficiently. By establishing this connection, you can enhance your experience, simplify deposits, and streamline withdrawals directly to your bank.

A smooth linkage process typically involves a few straightforward steps. Initially, you’ll need to provide some essential information regarding your bank account, including your routing and account numbers. This data is vital for establishing a secure connection.

Ensure you double-check the accuracy of the information you enter to avoid any delays. Once the account is linked successfully, you can enjoy a range of features, such as expedited transfers and balance management at your fingertips.

Additionally, maintaining security is paramount during this process. Utilize two-factor authentication and regularly monitor your account for any unauthorized activities to protect your financial information.

In summary, linking your bank account is an essential component of maximizing your financial interactions through digital platforms. A little time spent on this setup can lead to enhanced convenience and improved control over your funds.