The ability to transfer funds effortlessly has revolutionized participation in interactive entertainment venues. With the emergence of various financial technologies, users have access to a multitude of payment options that streamline the deposit and withdrawal processes. Navigating this landscape requires an awareness of associated expenses, ensuring that players make informed decisions about their transaction methods.

Financial platforms have introduced innovative solutions that cater specifically to the preferences of gamers. A deep dive into these systems reveals not only their convenience but also potential charges that may accompany transactions. A clear comprehension of these components is essential for anyone seeking to engage in virtual gaming experiences without encountering unexpected costs.

Assessing transaction methods involves examining how different services operate, what fees may arise, and the overall impact on one’s gaming budget. Understanding the nuances of these financial tools can greatly enhance the user experience, allowing for seamless enjoyment of entertainment while minimizing unnecessary expenses. This analysis offers valuable insights into making the best choices for monetary interactions in the realm of digital gaming.

When engaging in financial transactions via digital platforms, it’s essential to grasp the various elements that influence the final amount deducted. This understanding can significantly impact your overall experience, especially when transferring funds or making purchases. The nuances of these costs often vary, and being aware of them can lead to more informed decisions. Accurate knowledge allows users to manage their resources effectively and avoid unexpected surprises.

Several factors contribute to the incurred charges, including currency conversion rates, transaction types, and potential service costs. A close examination of these elements can illuminate patterns and help users anticipate what to expect. Familiarity with these aspects can enhance confidence in managing your financial interactions.

By analyzing the pricing structure and exploring the terms associated with different operations, individuals can optimize their strategies. Awareness of transaction implications enables the selection of the most beneficial options, fostering a more streamlined experience. Consequently, taking the time to investigate the intricacies involved can yield significant advantages for users.

When it comes to funding your gaming experience, establishments often impose specific minimum amounts that must be met for transactions. Understanding these base values is crucial, as they can influence your overall budget and strategy. These thresholds vary widely among platforms, reflecting each site’s policies regarding financial contributions.

Typically, the least amount required for a deposit can differ based on the chosen payment method, with some options offering greater flexibility than others. Additionally, many platforms may establish distinct limits for various types of players, such as newcomers or seasoned gamblers. It’s essential to evaluate these parameters before proceeding with any monetary commitments.

In many cases, the minimum deposit can be as low as a few dollars, appealing to players who wish to test the waters without significant risk. However, remaining informed about these restrictions will ensure that you allocate your funds effectively and enjoy a seamless and engaging experience.

When engaging in transactions across different currencies, it’s essential to be aware of potential costs that may arise from converting funds. These charges can vary based on the service provider and the specific currency pairs involved. Understanding these aspects ensures a smoother financial experience and helps in budgeting accurately.

Currency conversion costs typically manifest during the process of changing one currency into another. Such expenses may be applied as a percentage of the total amount or as a fixed fee, depending on the policies of the financial platform being utilized. This variability necessitates careful consideration, especially when dealing with international transactions.

Furthermore, exchange rates can fluctuate frequently, which may influence the overall amount received or sent. It’s prudent to review the rates applied at the time of the transaction to assess the true cost involved. Keeping an eye on these factors can aid in maximizing the value of your funds.

Lastly, some platforms might offer incentives or more favorable terms for specific currencies or account types, potentially mitigating the impact of conversion costs. It’s advisable to compare options available in the market to identify the most cost-effective choice for your needs.

When engaging with digital platforms, it’s vital to be aware of various constraints that may impact your financial activities. These boundaries can include the maximum and minimum amounts that can be processed, as well as specific conditions that apply to certain types of transactions.

Transaction limits can vary significantly based on various factors:

Additionally, there might be key restrictions that users should consider:

Being well-informed about these parameters is crucial for smooth financial transactions and avoiding any complications. Always check the latest updates directly from the service provider to ensure compliance with current terms and conditions.

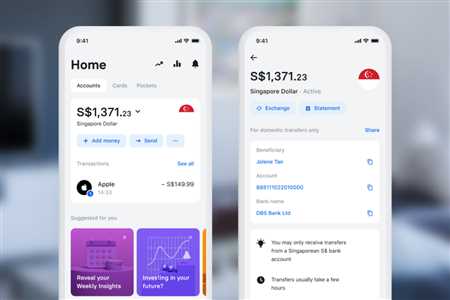

The financial framework associated with this digital banking solution can be quite intricate. Nonetheless, grasping the essential aspects provides clarity on how users can effectively manage their transactions. By breaking down the components, it becomes easier to see the potential costs and advantages available.

Primarily, the structure consists of various account tiers, each offering a unique set of services and possible charges. Free accounts allow users to engage in basic functionalities, while premium memberships unlock advanced features at a monthly expense. Understanding these levels assists in determining which option aligns best with individual needs.

Users should also be aware of currency conversion rates, which can influence the total cost of transactions. Beyond that, certain actions like withdrawal limits can incur additional costs depending on the chosen plan. Thus, being informed about these variations is crucial for optimizing financial transactions.

Ultimately, recognizing the core elements of the pricing structure enables users to navigate this system successfully, ensuring they utilize the service to its full potential while minimizing unnecessary expenses.

Subscriptions offer a variety of advantages tailored to enhance the user experience while managing financial transactions. By choosing the right plan, users can unlock numerous features that simplify their interactions with digital services.

The following highlights some key benefits of opting for a subscription model:

By selecting an appropriate subscription, users can not only optimize their transactions but also enjoy an enriched service that aligns with their preferences.

When engaging in transactions related to gaming platforms, players may encounter unexpected expenses that can impact their overall experience. These concealed costs often remain unnoticed until they appear on account statements, leaving individuals feeling frustrated. Being informed about potential pitfalls can help users navigate these financial waters more effectively.

One common tactic to unveil hidden expenses is to thoroughly read the terms and conditions associated with the payment processor. This documentation frequently contains essential information about any applicable charges that may arise during deposits or withdrawals. Additionally, consumers should stay vigilant for promotional offers, which may initially seem appealing but could disguise underlying costs.

Another strategy encompasses monitoring transaction history regularly. Users can gain insights into their spending patterns and identify any discrepancies or unauthorized charges. Furthermore, opting for payment methods that are known for transparency can significantly reduce the likelihood of encountering surprise costs.

Lastly, engaging with customer support can provide clarity regarding any unclear fees before committing to a transaction. By proactively addressing potential issues, individuals can enhance their gaming experience while ensuring their financial dealings remain straightforward and transparent.