In today’s fast-paced digital landscape, the demand for efficient and secure financial transactions is at an all-time high. Individuals are increasingly seeking options that not only prioritize speed but also ensure the utmost safety of their funds. Amidst a plethora of alternatives, some methods stand out as particularly advantageous for those wishing to move their earnings swiftly and securely.

Understanding the significance of prompt and safe transactions is essential for anyone looking to manage their finances effectively. A variety of services offer unique solutions, ensuring that users can access their resources without unnecessary delays or complications. With advancements in technology, many financial processes have become streamlined, allowing for heightened convenience.

Whether it’s about receiving funds from various sources or managing personal finances, the right services can make all the difference. Users are increasingly turning to systems that facilitate effortless, straightforward, and safe handling of their money, fostering a sense of confidence and satisfaction in their financial dealings.

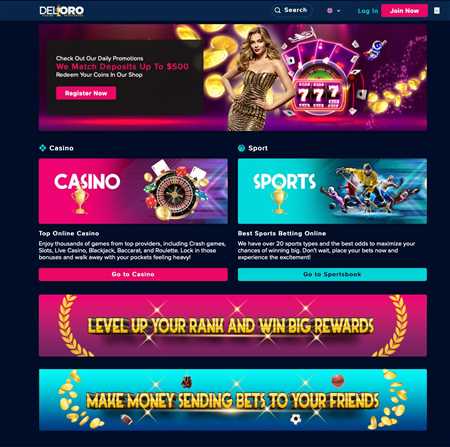

When it comes to receiving funds from online gaming platforms, many players find comfort in traditional financial systems. These methods not only facilitate smooth transactions, but they also offer a sense of security that is essential for users managing their finances. Choosing a popular payment option can enhance the overall experience and streamline the process of accessing funds accrued through gameplay.

One of the key advantages of utilizing this approach is the ease with which players can move their funds. With most financial establishments providing user-friendly interfaces, accessing earnings has never been simpler. Users can initiate transactions with just a few clicks, eliminating the need for complicated procedures or lengthy wait times.

Additionally, the trust that comes with traditional financial services cannot be overlooked. Many find solace in using well-known institutions that have established a long-standing history of safeguarding clients’ information and funds. This assurance contributes to a more relaxed atmosphere, allowing players to focus on their enjoyment rather than worry about potential risks.

Ultimately, recognizing the benefits of employing this finance system can lead to a more fulfilling and straightforward experience for avid players. Making informed choices about how to receive funds can significantly impact one’s overall satisfaction and peace of mind.

This section outlines the numerous benefits associated with utilizing financial institution services for moving funds. Such mechanisms offer a safe and efficient avenue for securing money while maintaining peace of mind during transactions.

One significant benefit is the heightened level of security these services provide. Users can rest assured that their sensitive information is protected through advanced encryption protocols, minimizing the risk of unauthorized access.

Another notable advantage is the convenience of processing transactions from the comfort of one’s home. The ability to initiate and manage financial activities online streamlines the experience, saving time and effort compared to traditional methods.

Additionally, this approach often features lower fees compared to alternative options. Many individuals appreciate the cost-effectiveness that comes with choosing this form of financial movement, making it an attractive choice for regular users.

Furthermore, the speed of completing these transactions can be a considerable advantage. Funds typically appear in the recipient’s balance relatively quickly, allowing for instant access and enjoyment of received funds without unnecessary delays.

Finally, utilizing these services fosters transparency by providing detailed records of all movements. Users can easily track their financial activities, facilitating better management and financial planning.

When it comes to moving funds, the assurance of safety and dependability plays a crucial role in the decision-making process. Individuals seek solutions that not only prioritize privacy but also ensure that their assets are handled with utmost care. A secure environment fosters confidence and contributes to a seamless experience for users.

Several factors contribute to the overall security and trustworthiness of financial exchanges:

Moreover, the reputation of the service provider plays a vital role in establishing trust. Users should consider:

Through these measures, the peace of mind associated with transferring funds can be significantly enhanced, allowing individuals to focus on the enjoyment of their activities without unnecessary concerns.

In today’s fast-paced digital environment, ease of use and accessibility are paramount for individuals seeking to manage their financial activities effortlessly. Users now prefer solutions that facilitate swift interactions, eliminating unnecessary hurdles in their financial dealings. This growing inclination towards streamlined processes has led to the adoption of various services that enhance user experience.

Accessibility is a key factor that makes these solutions appealing across different demographics. With the advent of mobile technology, individuals can now engage with their finances from virtually anywhere, whether they are at home or on the go. This capability ensures that users can initiate and complete their transactions with minimal effort, aligning with their dynamic lifestyles.

Moreover, the variety of platforms available today caters to a wide range of preferences. From mobile applications to online portals, each option is designed to provide users with a seamless experience. Intuitive interfaces further simplify navigation, allowing both novice and experienced individuals to utilize these services without extensive training.

Additionally, the integration of advanced security measures instills confidence, further enhancing the appeal of these facilities. Individuals can engage in financial activities with peace of mind, aware that their data is safeguarded. As convenience continues to be a driving force in the financial sector, the accessibility of these services remains a fundamental aspect of their growing popularity.

Receiving funds from online gaming platforms requires a systematic approach to ensure a smooth and secure process. Following specific steps can help you manage the payment process seamlessly.

By adhering to these outlined steps, you can facilitate a smooth experience in acquiring your earnings from online platforms.

The process of confirming identity and ensuring security is crucial when it comes to financial activities involving funds. It establishes a level of trust between parties and protects against potential fraud. This stage typically requires individuals to provide certain documentation and information to validate their identity before proceeding with any transactions.

During this phase, entities may request various forms of identification, such as government-issued ID, proof of address, or other relevant documents. These measures are designed to safeguard customers and ensure that all activities are legitimate and authorized. The verification process not only enhances security but also offers peace of mind to users who engage in financial exchanges.

Once the required documentation is submitted, the review period may vary depending on the institution’s policies. However, timely processing is essential to maintain customer satisfaction and facilitate smooth operations. After successful verification, users can enjoy seamless access to their funds, confident in the integrity of their transactions.

When navigating the landscape of monetary movement, certain challenges can arise that may impede the smooth experience one anticipates. Being aware of these potential obstacles can facilitate a more seamless and stress-free experience when accessing funds from online platforms.

By recognizing these common issues and taking proactive measures, one can ensure a more effective and enjoyable experience when handling financial movements from such platforms.